Are Banks Losing Their Purpose? Exploring the Shift to Digital Banking and Options for Cash Holders

Are Banks Losing Their Purpose? Exploring the Shift to Digital Banking and Options for Cash Holders

In a world increasingly dominated by digital transactions, traditional banking institutions are devolving their services in ways that compromise their fundamental purpose. A recent letter from Scotiabank highlights this trend, announcing that their Kentville branch will transition to offering advice services only, effectively removing over-the-counter cash services. This change reflects a broader shift in the banking industry, raising questions about the role of banks in a digital-first economy and the options available for consumers who prefer to manage their finances through cash.

The Transition to Digital Banking

The push towards digital banking has been swift, driven not only by consumer preferences but also by unelected international organizations, such as the World Economic Forum (WEF), the International Monetary Fund (IMF), and the Bank for International Settlements (BIS). These organizations advocate for the adoption of digital currencies and cashless societies, suggesting that traditional banking services are becoming obsolete. While some customers appreciate the convenience of digital transactions, many others feel that banks are "throwing the baby out with the bathwater" by abandoning the foundational services that have long defined their role in society. Namely proving bills of exchange - CASH!

The Issue of Transaction Tracking

One of the most pressing concerns surrounding the shift to digital banking is the pervasive tracking of transactions. Critics question why every transaction needs to be monitored and recorded. This trend raises several important issues:

1. Loss of Privacy: The need for constant tracking means that personal financial habits and transactions are no longer private. Consumers may feel uncomfortable with the idea that their spending patterns, savings, and even charitable contributions are being observed and analyzed.

2. Surveillance Economy: The push for transaction tracking contributes to a broader surveillance economy, where individuals' behaviors are constantly monitored for commercial or regulatory purposes. This can lead to a chilling effect on personal freedoms and choices.

3. Control and Manipulation: With detailed tracking of financial transactions, there is potential for misuse of data. Financial institutions, corporations, and even governments may use this information to manipulate consumer behavior or impose restrictions based on spending patterns.

4. Digital Exclusion: As banks increasingly prioritize digital transactions, those who prefer cash or lack access to digital banking technologies may be marginalized. This exclusion can disproportionately affect vulnerable populations, including the elderly or those in low-income communities.

5. Security Risks: With every transaction being tracked and stored, the risk of data breaches increases. Cybercriminals may target financial institutions to access sensitive information, leading to identity theft and financial loss.

Advocating for a Cash-Friendly Future

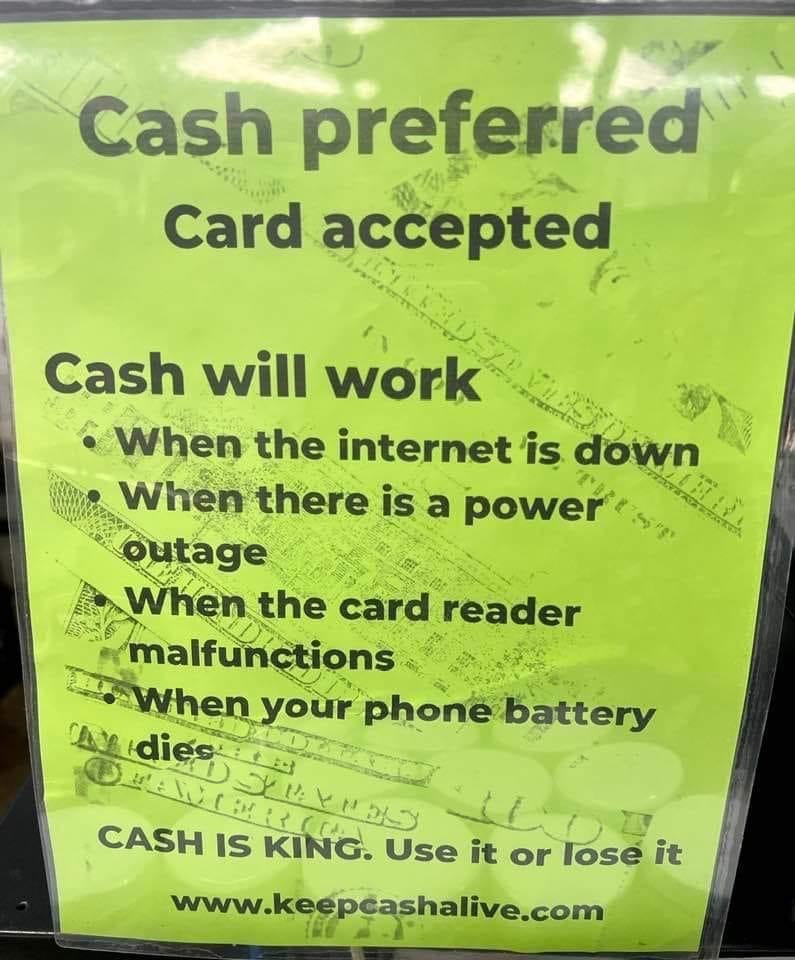

Rather than accepting a future dominated by digital transactions, it’s essential to push back and advocate for a world where cash remains king. Here are some ways to champion the use of cash in everyday transactions:

1. Support Cash-Only Businesses: Actively choose to patronize local businesses that accept only cash. This not only helps maintain a cash economy but also fosters community engagement and supports small enterprises.

2. Educate Others: Raise awareness about the importance of cash as a viable payment method. Share information about the risks associated with digital banking and the benefits of using cash for personal finance.

3. Advocate for Traditional Banking Services: Engage with local banks and credit unions to express your desire for continued cash services. Encourage them to maintain over-the-counter transactions and support cash-friendly policies.

4. Promote Financial Literacy: Encourage discussions around financial literacy that include the advantages of cash management. Help others understand how to budget and manage their finances using cash instead of relying solely on digital transactions.

5. Community Initiatives: Organize community events focused on cash transactions, such as cash-only markets or swap meets, to highlight the benefits of cash in everyday life.

6. Legislative Action: Support initiatives that advocate for the right to use cash as a means of payment. Engage with policymakers to ensure that cash remains an accessible option for all consumers.

As banks like Scotiabank shift towards a digital-only model, it’s essential to recognize that advocating for cash is not merely about nostalgia; it’s about preserving personal choice, privacy, and the ability to engage in financial transactions without oversight. The influence of unelected international organizations on banking practices raises critical questions about consumer rights and the future of personal finance. By pushing back against the digital-only narrative and promoting cash as a legitimate and necessary option, we can create a future where cash remains a vital part of everyday transactions. Cash should continue to hold its place as "king," ensuring that all individuals have the freedom to manage their finances on their own terms.

I would suggest people do the same as when TD bank tried its 'digital transition' and thousands of people moved their money out in process (mostly to credit unions). I wrote about this last June, should anyone be interested: https://wdavidward.substack.com/p/the-electronic-vs-digital-debate

Banks have an incredibly privileged position, in that the government allows them to substitute their 'bank credit' (bank fiat) for our national sovereign currency (and then collect interest on that 'money'). The deal is, they have to handle physical cash (that is, real Bank of Canada-created sovereign money). Now they want to renege on this arrangement . The Bank of Canada should step in to prevent this. I

I don't use this bank, but its customers should all write to complain, and start pulling deposits out to underscore their point, and we should all write to the Bank of Canada to insist commercial banks must continue to offer this essential service.